In an era marked by financial uncertainty and fluctuating markets, many buyers are searching for dependable avenues to secure their retirement financial savings. One such avenue that has gained vital traction is the Gold Particular person Retirement Account (IRA). As conventional retirement accounts face volatility, Gold IRA companies have emerged as a beacon of stability, providing investors a approach to diversify their portfolios and hedge against inflation. This article explores the rise of Gold IRA companies, their advantages, and the considerations investors ought to keep in thoughts when selecting one.

Understanding Gold IRAs

A Gold IRA is a kind of self-directed Particular person Retirement Account that permits investors to hold physical gold and other treasured metals as a part of their retirement portfolio. Not like conventional IRAs, which usually include stocks, bonds, or mutual funds, Gold IRAs allow individuals to put money into tangible belongings. This funding strategy is particularly interesting during intervals of financial instability, as gold has traditionally maintained its value and has been seen as a protected haven asset.

The advantages of Investing in Gold IRAs

- Hedge In opposition to Inflation: Gold has long been considered a hedge towards inflation. When fiat currencies lose worth on account of inflationary pressures, gold typically appreciates in worth, offering a safeguard for traders' buying energy.

- Portfolio Diversification: Including gold in a retirement portfolio can present diversification benefits. As an asset class that always behaves in another way from stocks and bonds, gold may also help cut back total portfolio threat.

- Tangible Asset: Unlike stocks or bonds, gold is a physical asset that can be held and stored. This tangibility gives a sense of safety for a lot of traders, especially during instances customers reviews of gold ira companies economic uncertainty.

- Tax Advantages: Gold IRAs provide the identical tax advantages as traditional IRAs. Contributions may be tax-deductible, and the expansion of the funding is tax-deferred till withdrawal, permitting for doubtlessly larger accumulation of wealth over time.

The Role of Gold IRA Companies

Gold IRA companies play an important role in facilitating the strategy of investing in gold by retirement accounts. These corporations present a range of providers, including:

- Account Setup: Gold IRA companies assist buyers in establishing their self-directed IRAs, ensuring compliance with IRS laws and facilitating the mandatory paperwork.

- Custodianship: The IRS requires that all IRAs have a custodian. Gold IRA companies usually accomplice with permitted custodians who handle the storage and security of the bodily gold.

- Investment Guidance: Many Gold IRA companies supply educational resources and customized investment advice to help shoppers make informed selections about their gold investments.

- Buyback Packages: Respected Gold IRA companies usually provide buyback applications, allowing traders to promote their gold back to the corporate at aggressive prices when they select to liquidate their belongings.

Selecting the best Gold IRA Company

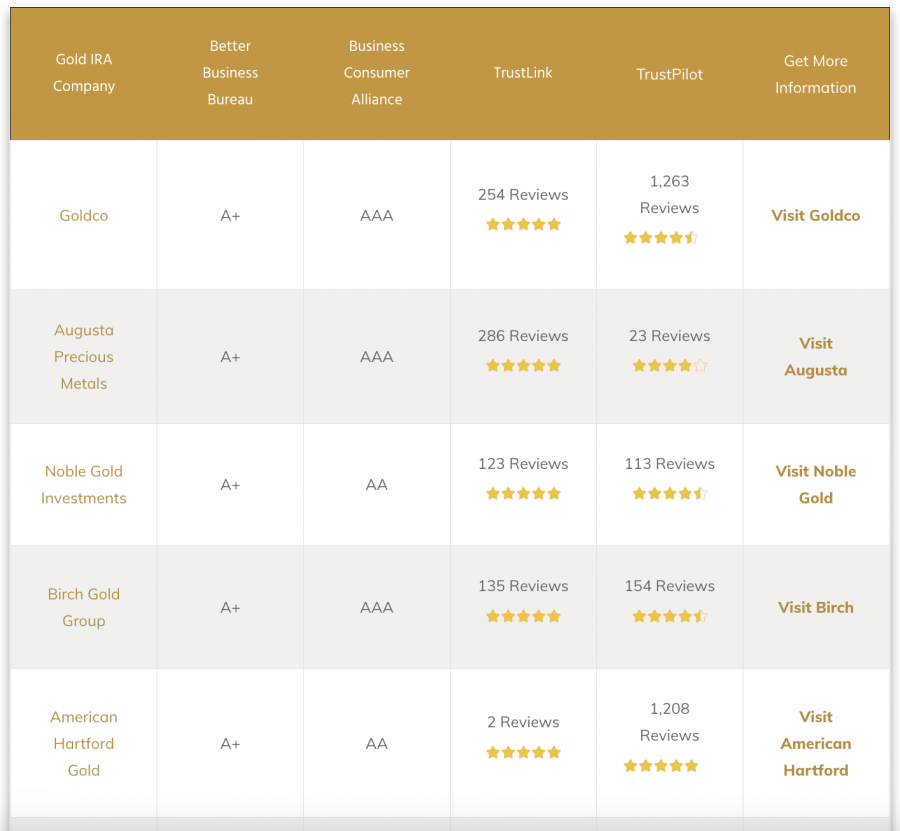

Selecting the best Gold IRA company is a important step for buyers looking to diversify their retirement portfolios. Here are several elements to contemplate:

- Reputation and Evaluations: Research the company's fame by reading customer reviews of the best gold ira companies and testimonials. Look for firms which have a history of constructive customer experiences and transparent practices.

- Charges and Prices: Completely different Gold IRA companies have varying charge buildings, including setup charges, annual upkeep charges, and storage charges. It's important to understand these costs and how they might impact your investment returns.

- Customer support: An organization's customer service can significantly influence your expertise. Look for a corporation that gives responsive and educated assist to handle any questions or concerns you could have.

- Educational Sources: A reputable gold ira companies compared IRA company should provide educational materials to help traders understand the intricacies of gold investing and the advantages of including it of their retirement accounts.

- Transparency: Be certain that the corporate is transparent about its operations, charges, and policies. A reliable Gold IRA company will provide clear information without hidden fees or difficult phrases.

Potential Risks and Issues

While Gold IRAs supply numerous benefits, investors should also be aware of potential dangers and considerations:

- Market Volatility: Though gold is often seen as a stable investment, its price can still be subject to fluctuations. Buyers ought to be ready for the possibility of brief-term volatility.

- Storage and Insurance coverage: Physical gold ira companies near me requires safe storage, which might incur extra costs. Buyers ought to be sure that they what are gold ira companies conscious of storage options and related charges.

- Liquidity: Selling bodily gold can take time and should contain extra prices. Traders ought to consider their liquidity needs when investing in a Gold IRA.

- Regulatory Compliance: Gold IRAs must adjust to IRS rules, which might be advanced. Investors should ensure that their chosen Gold IRA company adheres to these regulations to avoid potential penalties.

Conclusion

The rise of Gold IRA companies displays a growing trend amongst buyers in search of stability and safety for their retirement savings. By providing a singular funding automobile that allows for the inclusion of bodily gold in retirement accounts, these firms provide a worthwhile service in as we speak's financial panorama. However, potential investors should conduct thorough research and consider varied factors when choosing a Gold IRA company. By doing so, they could make informed choices that align with their monetary objectives and risk tolerance, in the end making certain a extra secure retirement.

Because the financial landscape continues to evolve, the position of Gold IRA companies will doubtless develop into increasingly outstanding, offering a viable option for these trying to safeguard their monetary future by means of tangible belongings. With the suitable guidance and a transparent understanding of the benefits and dangers, investors can harness the potential of Gold IRAs to secure their retirement savings against the uncertainties of the market.

![Best Gold IRA Companies in New York: Top Choices \u0026 Key Insights [December 2025] - Gold IRA Blueprint](https://goldirablueprint.com/wp-content/uploads/2024/04/Default_GOLD_precious_metals_0-1.jpg)